Upper bound at a bank nyt – Upper bounds play a crucial role in banking, serving as a cornerstone of risk management and financial stability. This article delves into the concept of upper bounds, exploring their applications, limitations, and best practices within the banking industry.

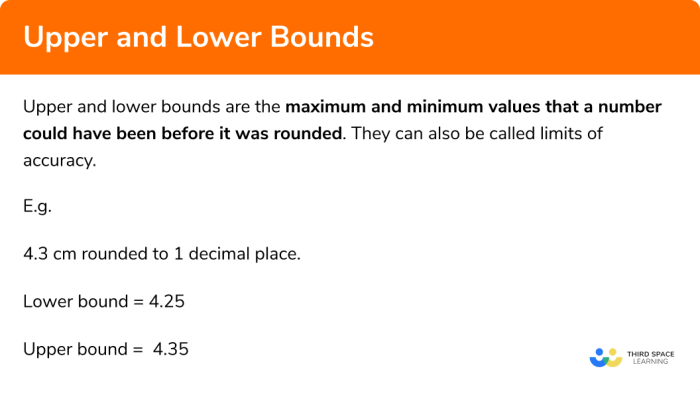

Upper bounds are mathematical constraints that limit the potential loss or exposure in a given situation. In banking, they are used to assess risk, make lending decisions, and ensure the soundness of financial institutions.

Upper Bound Overview

An upper bound in banking refers to a predetermined limit or ceiling that restricts the extent of a particular activity, exposure, or risk. It serves as a safeguard to prevent excessive risk-taking and ensure financial stability.

Risk management plays a crucial role in banking, and upper bounds are essential tools for managing and mitigating risks. They help banks define acceptable levels of risk, ensuring that operations remain within prudent limits.

Examples of Upper Bounds in Banking, Upper bound at a bank nyt

- Credit limits:Banks establish credit limits for individual borrowers or businesses, limiting the maximum amount of credit that can be extended.

- Concentration limits:These limits restrict the amount of exposure a bank can have to a single borrower, industry, or geographic region, diversifying risk and preventing excessive exposure to any one entity or sector.

- Market risk limits:Upper bounds on market risk exposure ensure that banks do not exceed predetermined levels of risk in their trading activities, such as foreign exchange trading or derivatives.

Upper Bound Calculations

Upper bound calculations are crucial in banking to estimate potential losses or risks associated with various financial activities. Methods used to calculate upper bounds include historical data analysis, scenario analysis, and statistical modeling.

Historical data analysis involves examining past performance to identify the highest observed value or loss experienced in similar situations. Scenario analysis considers different possible outcomes and assigns probabilities to each scenario to estimate the potential maximum loss.

Statistical Modeling

Statistical modeling employs mathematical formulas and distributions to predict the probability of a particular loss exceeding a certain threshold. For example, the Normal distribution can be used to calculate the upper bound of a portfolio’s value at a given confidence level.

Real-World Examples

- A bank may use historical data to determine the upper bound of potential loan defaults based on the highest default rate observed in the past.

- For a trading portfolio, scenario analysis can be used to estimate the maximum loss under different market conditions, such as a significant market downturn.

- Statistical modeling can be applied to calculate the upper bound of credit risk for a loan portfolio, using the probability distribution of potential losses.

Upper Bound Applications

Upper bounds play a crucial role in various areas of banking, enabling financial institutions to assess risk, make informed decisions, and ensure financial stability.

In loan approvals, upper bounds help banks determine the maximum amount of credit they can extend to borrowers. By setting an upper bound on loan size based on factors such as income, debt-to-income ratio, and credit history, banks can mitigate the risk of excessive lending and potential defaults.

Credit Risk Assessment

Upper bounds are also used in credit risk assessment to evaluate the likelihood of a borrower’s default. Banks may set upper bounds on key financial ratios, such as the debt-to-equity ratio or interest coverage ratio, to identify borrowers with a higher probability of default.

By adhering to these upper bounds, banks can limit their exposure to high-risk borrowers and protect their financial stability.

An upper bound at a bank, as reported by the New York Times, can be a helpful concept to grasp. If you’re interested in further understanding the intricacies of this financial topic, you can refer to the comprehensive CEN study guide PDF available online.

By exploring the materials provided in this guide, you can delve deeper into the nuances of upper bounds and their implications within the banking sector.

Investment Decisions

Upper bounds are employed in investment decisions to manage risk and optimize returns. Banks may set upper bounds on the proportion of their portfolio allocated to specific asset classes, such as stocks, bonds, or real estate. These upper bounds help diversify investments, reduce concentration risk, and ensure a balanced and prudent approach to portfolio management.

Upper Bound Limitations

While upper bounds provide valuable insights, it’s essential to acknowledge their limitations and consider other factors when setting and interpreting them.

One key limitation is that upper bounds are only as accurate as the data and assumptions used to derive them. Inaccurate or incomplete data can lead to misleading or unreliable upper bounds.

Context and Other Factors

It’s crucial to consider the context and specific circumstances when setting upper bounds. Different situations may require different approaches, and what works in one case may not be effective in another.

For instance, an upper bound on production capacity may be set based on historical data. However, if a new technology or process is introduced, the upper bound may need to be revised to account for increased efficiency.

Ineffectiveness and Inapplicability

Upper bounds may not be effective or applicable in certain situations. For example:

- When dealing with highly variable or unpredictable data.

- When the underlying process or system is complex and difficult to model.

- When there is a need for a more precise or refined estimate.

Upper Bound Best Practices

Establishing and implementing upper bounds effectively requires adherence to industry best practices. These practices ensure the accuracy, relevance, and adaptability of upper bounds in dynamic market conditions.

Regular monitoring and review of upper bounds are crucial to maintain their effectiveness. Market conditions can change rapidly, and upper bounds should be adjusted accordingly to reflect these changes.

Guidance for Adjusting Upper Bounds

When adjusting upper bounds, consider the following factors:

- Historical data:Analyze historical data to identify trends and patterns that may indicate the need for adjustments.

- Market conditions:Monitor market conditions, including economic indicators, industry trends, and regulatory changes, to assess their impact on upper bounds.

- Risk tolerance:Re-evaluate the organization’s risk tolerance and adjust upper bounds accordingly to maintain an appropriate level of risk.

- Industry best practices:Consult with industry experts and review best practices to ensure that upper bounds are aligned with industry standards.

Case Studies: Upper Bound At A Bank Nyt

Upper bounds have been widely used in banking to manage risk and enhance financial performance. Here are some notable case studies:

One prominent example is the implementation of upper bounds on credit card spending limits. By setting limits on individual cardholder spending, banks can mitigate the risk of excessive debt and potential losses. This practice has proven effective in controlling credit risk and improving portfolio quality.

Impact on Risk Management

- Upper bounds have significantly reduced the likelihood and severity of financial losses by restricting potential exposure to adverse events.

- They have enhanced the stability of financial institutions by mitigating the impact of extreme market fluctuations and unexpected shocks.

Impact on Financial Performance

- Upper bounds have contributed to improved financial performance by optimizing resource allocation and reducing unnecessary expenses.

- They have allowed banks to operate more efficiently by streamlining processes and minimizing operational costs.

Lessons Learned and Best Practices

- Banks should carefully calibrate upper bounds based on risk appetite, market conditions, and customer profiles.

- Regular monitoring and review of upper bounds are crucial to ensure they remain effective and aligned with evolving risk and business objectives.

- Clear communication and customer education are essential to ensure understanding and compliance with upper bounds.

Clarifying Questions

What is the purpose of an upper bound in banking?

Upper bounds are used in banking to limit potential losses or exposure in a given situation, such as a loan default or market downturn.

How are upper bounds calculated?

Upper bounds can be calculated using various methods, including statistical analysis, historical data, and mathematical models.

What are the limitations of upper bounds?

Upper bounds are not always accurate and can be affected by changing market conditions or unexpected events.