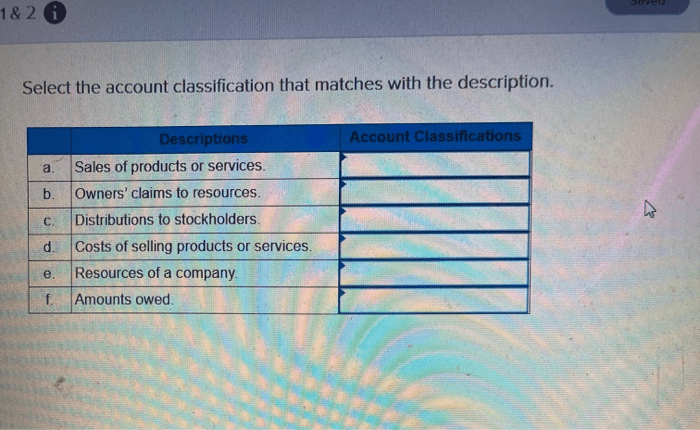

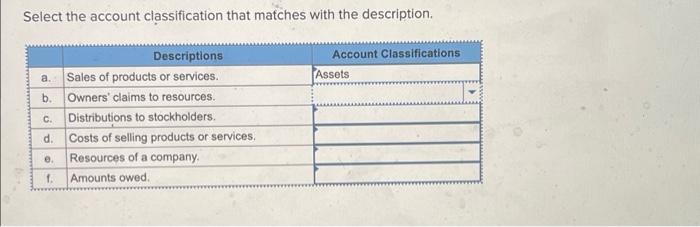

Select the account classification that matches with the description. – In the realm of accounting, account classification plays a pivotal role in organizing and interpreting financial data. This article delves into the intricacies of account classification, exploring its purpose, methods, and applications, providing a comprehensive understanding of how it shapes the financial landscape.

Account classification involves categorizing accounts based on their economic characteristics, enabling accountants to present a clear and concise picture of an organization’s financial position and performance.

1. Account Classification Concepts: Select The Account Classification That Matches With The Description.

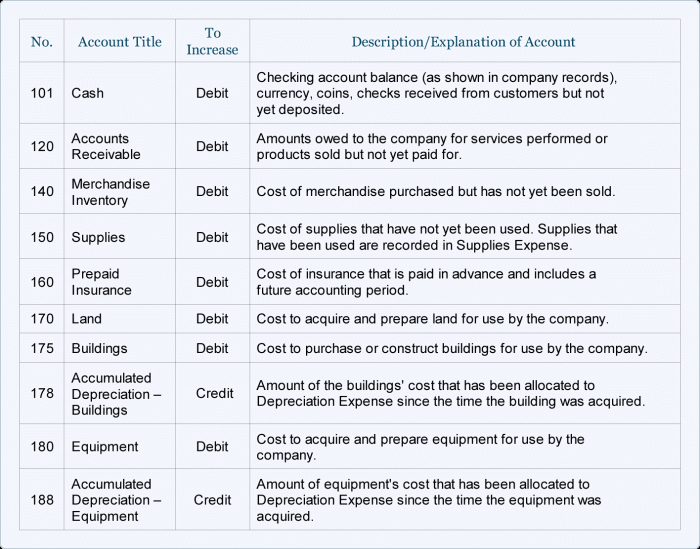

Account classification is the process of organizing and grouping accounts into meaningful categories based on their economic characteristics and functions. It is a fundamental step in the accounting process and plays a vital role in financial reporting and analysis.

The purpose of account classification is to provide a systematic framework for understanding the financial position and performance of a company. It allows users of financial statements to quickly and easily identify the types of assets, liabilities, equity, income, and expenses that a company has.

There are different methods of account classification, including:

- By liquidity

- By permanence

- By function

The most common method of account classification is by function. This method groups accounts into the following categories:

- Assets

- Liabilities

- Equity

- Income

- Expense

Each of these categories has its own unique characteristics and subcategories.

FAQ

What is the significance of account classification?

Account classification is essential for organizing financial data, ensuring consistency in reporting, and facilitating financial analysis and decision-making.

How does account classification impact financial statements?

Account classification forms the basis for preparing financial statements such as the balance sheet and income statement, providing a structured framework for presenting financial information.