Poll tax definition ap gov? Dive into the fascinating history, impact, and ongoing debate surrounding poll taxes, a tool historically used to disenfranchise marginalized communities and shape political power. Get ready for a captivating exploration that will shed light on this complex issue.

Poll taxes have left an undeniable mark on the American political landscape, and understanding their definition and implications is crucial for comprehending the ongoing fight for voting rights and equal representation.

Definition of Poll Tax

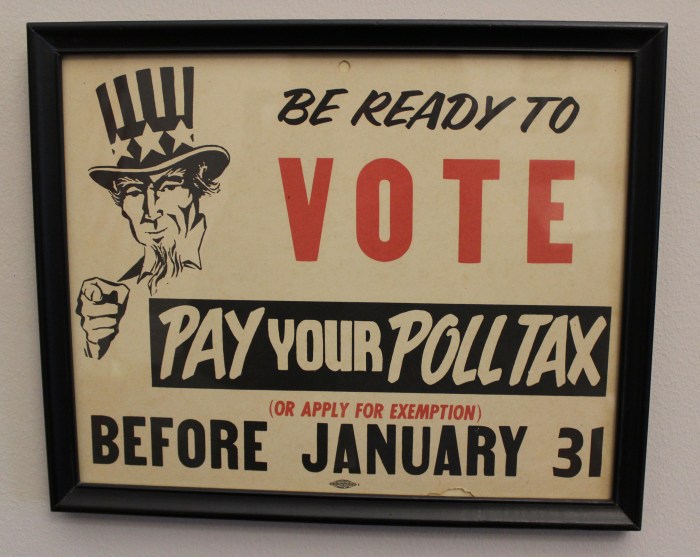

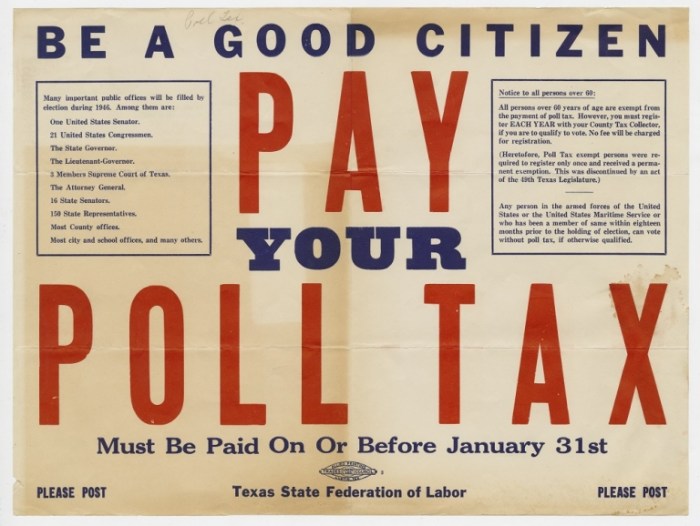

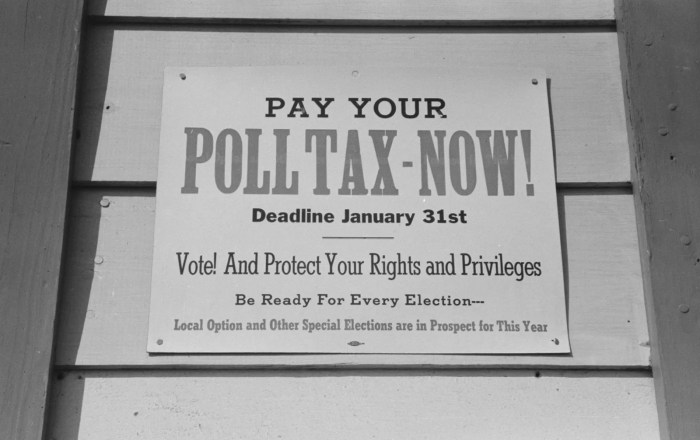

A poll tax is a tax levied on individuals simply for being eligible to vote in an election. It is a form of voter suppression, as it can make it difficult for low-income individuals to exercise their right to vote.

Historical Examples

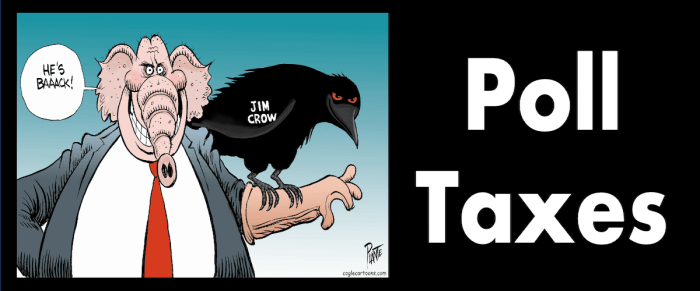

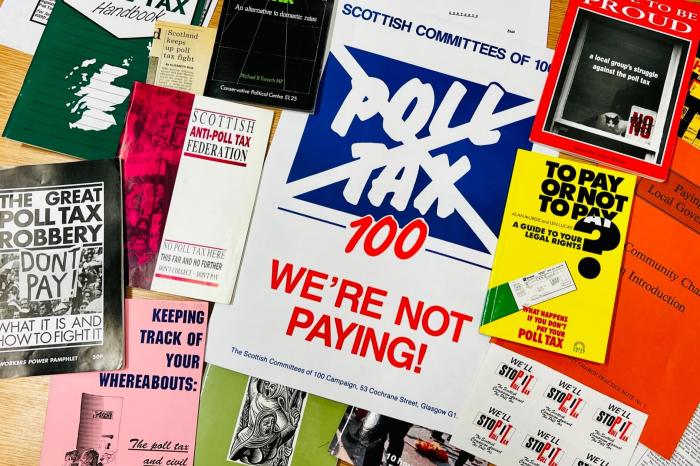

Poll taxes have been used throughout history to disenfranchise certain groups of people. In the United States, poll taxes were used to prevent African Americans from voting after the passage of the 15th Amendment, which granted them the right to vote.

Poll taxes were also used in other countries, such as Great Britain and Australia, to restrict the franchise.

Legal Basis

In the United States, the Supreme Court ruled in Harper v. Virginia Board of Elections (1966) that poll taxes are unconstitutional. The Court held that poll taxes violate the Equal Protection Clause of the 14th Amendment, which prohibits states from denying any person “within its jurisdiction the equal protection of the laws.”

Impact of Poll Taxes

Poll taxes, a form of voting restriction, have had a profound impact on voter participation, particularly among marginalized communities. Their primary goal was to disenfranchise specific groups, thereby maintaining political power in the hands of the elite.

One significant impact of poll taxes was the decline in voter turnout. Imposing a fee to vote created a financial barrier, effectively excluding low-income individuals and communities of color from participating in the electoral process. This suppression of the vote had a direct impact on the representation of these groups in government and policy-making.

Disproportionate Effect on Marginalized Communities

Poll taxes disproportionately affected marginalized communities, such as African Americans in the post-Reconstruction South. These communities faced additional barriers to voting, including literacy tests, grandfather clauses, and intimidation tactics. The combination of poll taxes and other restrictions created a system that systematically excluded people of color from political participation.

Role in Maintaining Political Power, Poll tax definition ap gov

Poll taxes played a crucial role in maintaining political power by limiting the electorate to those who could afford to pay the fee. This allowed dominant political groups to control elections and pass laws that favored their interests. By disenfranchising marginalized communities, poll taxes perpetuated a cycle of exclusion and inequality.

Poll tax, as defined in AP Government, is a fee that citizens must pay in order to vote. While this definition provides a basic understanding of poll taxes, it’s important to delve deeper into the complexities of this topic. If you’re looking for more information on solving equations like “solve for w 5w 9z 2z 3w,” I recommend checking out this resource . Returning to the topic of poll taxes, it’s crucial to understand their historical significance and the ongoing debates surrounding their use.

Legal Challenges to Poll Taxes

Poll taxes have faced numerous legal challenges in the United States. The most significant of these was Harper v. Virginia Board of Elections(1966).

Harper v. Virginia Board of Elections

In Harper, the Supreme Court ruled that poll taxes were unconstitutional. The Court held that poll taxes violated the Equal Protection Clause of the Fourteenth Amendment because they discriminated against poor voters. The Court reasoned that poll taxes had the effect of denying poor voters the right to vote, which was a fundamental right protected by the Constitution.

Current Legal Status of Poll Taxes

As a result of Harper, poll taxes are now unconstitutional in the United States. The Twenty-fourth Amendment to the Constitution, ratified in 1964, explicitly prohibits poll taxes for federal elections. The Voting Rights Act of 1965 also prohibits poll taxes for state and local elections.

Contemporary Issues Related to Poll Taxes

Despite the abolition of poll taxes, voter suppression remains a significant concern in contemporary society. Modern forms of voter suppression often resemble poll taxes in their discriminatory intent and impact on marginalized communities.

Voter ID Laws

Voter ID laws require voters to present government-issued photo identification at the polls. Proponents argue that these laws prevent voter fraud, but critics contend that they disproportionately disenfranchise low-income voters and voters of color, who are less likely to possess the required identification.

For example, a study by the Brennan Center for Justice found that strict voter ID laws could prevent as many as 2.4 million eligible voters from casting ballots.

The ongoing debate over voter ID laws highlights the tension between preventing voter fraud and ensuring access to voting for all citizens.

Importance of Ensuring Access to Voting

Ensuring access to voting is crucial for a healthy democracy. When citizens are prevented from voting, their voices are silenced, and the government becomes less representative of the population it serves.

It is essential to implement measures that make voting accessible to all eligible citizens, regardless of their income, race, or other factors.

FAQ Summary: Poll Tax Definition Ap Gov

What is the definition of a poll tax?

A poll tax is a fee that must be paid in order to vote. Historically, poll taxes have been used to disenfranchise marginalized communities, particularly African Americans in the United States.

How have poll taxes been implemented historically?

Poll taxes have been implemented in various forms throughout history, including as a requirement to vote in elections, to hold public office, or to access basic services such as education or marriage licenses.

What is the legal basis for poll taxes in the United States?

Poll taxes were once legal in the United States under the 24th Amendment to the Constitution. However, the Supreme Court ruled in 1966 that poll taxes are unconstitutional, as they violate the Equal Protection Clause of the 14th Amendment.